“For small business owners, failing to anticipate an expense or its magnitude could prove disastrous and cripple the organization before it has had time to grow. “So much of business is planning and reacting to the unexpected,” said Doug Keller, a financial planner at Peak Personal Finance. Often, you can’t predict when something will go over budget. If your business operates on a project-to-project basis, you know that every client is different and no two projects will turn out exactly the same. A good budget should be balanced and provide an accurate ballpark estimate of what it will take to run your business. When crafting a budget for your small business, these seven steps can help you ensure you’re being not only fiscally responsible but also realistic about what you’ll need to spend to support operations.

SMALL BUSINESS BUDGET FREE

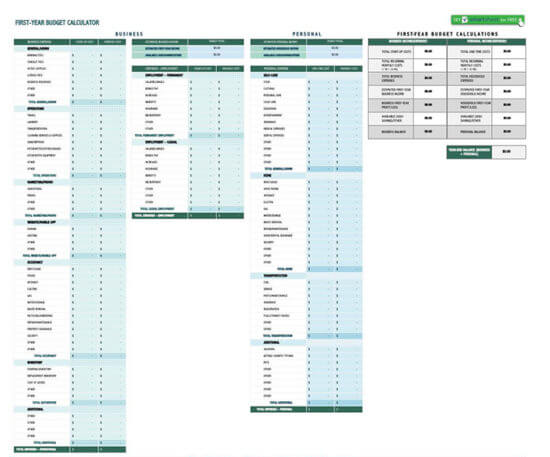

This guide offers some useful tips to help you craft a budget that works to support your small business’s growth.Įditor’s note: Need accounting for your business? Fill out the below questionnaire to have our vendor partners contact you with free information. As a small business owner, you’ll want to create and maintain a reliable budget to keep your finances in check. It’s no surprise that starting a business requires a decent chunk of money, but expenses don’t end once you’re up and running. This article is for entrepreneurs who want to improve their budgeting skills to better manage their small business’s finances.Regularly revisit your budget to determine if it still makes sense given your business’s current circumstances, and revise it accordingly.Involving your team to get an understanding of what it takes to support operations can help you craft a budget grounded in reality.Creating a budget (and sticking to it) is a critical aspect of managing a small business’s finances.

0 kommentar(er)

0 kommentar(er)